Surveillance

Increase Efficiency with Normalized Data and Configurable Alerts

Bring Your Trading and Commission Surveillance into the 21st Century

Compliance officers no longer need to settle for expensive, hard-coded surveillance platforms for mitigating the reputational, regulatory and operational risk of trading and commissions. Today’s broker- dealers need a flexible, cost-effective surveillance platform that provides configurable alerts and access to normalized data with business intelligence. Sycamore provides a more configurable, data-driven platform that efficiently connects with all your home office operations. With millions of records and data points to analyze, you need to be able to drill down into the details to conduct what-if analysis at the branch and regional level. We collect and normalize data from multiple sources into a consistent format, then apply Salesforce's Tableau CRM (formerly Einstein Analytics) to make your surveillance alerts and analysis become more flexible, configurable and powerful.

Cost-Effective

Packed with standard broker-dealer surveillance alerts and normalized data for half the price of legacy offerings

Simple to Manage & Maintain

Cloud-based, native Salesforce application that lets you adjust your own rules – eliminating customization costs

Modern, Efficient & Intelligent

No more statement downloads. We normalize the data, let you filter and fine-tune your own views, and make analysis fast, easy and powerful

Flexible & Evolutionary

Easily configurable and flexible to evolve and scale with your changing or growing business

Standard Alerts for Broker-Dealers

We believe less is more. Rather than hard-coding hundreds of alerts that are difficult and expensive to customize, our platform is designed to let you slice account, trading and commission data with just a click, and configure your own rules and views to quickly flag issues and get the answers you need.

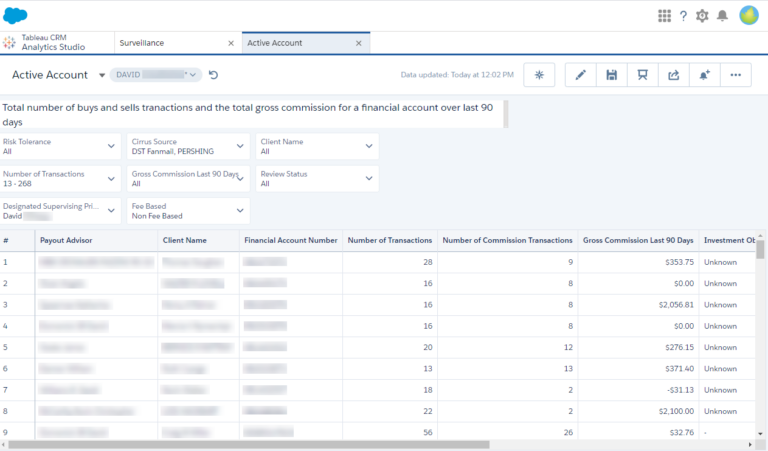

Active Accounts

Build and save your own views, as many as you want, and set filters for supervisors

Configure default filters any way you desire

Review transactions, add comments, and run batch updates

Align investment objective with allocation percentages (growth, income) in each account

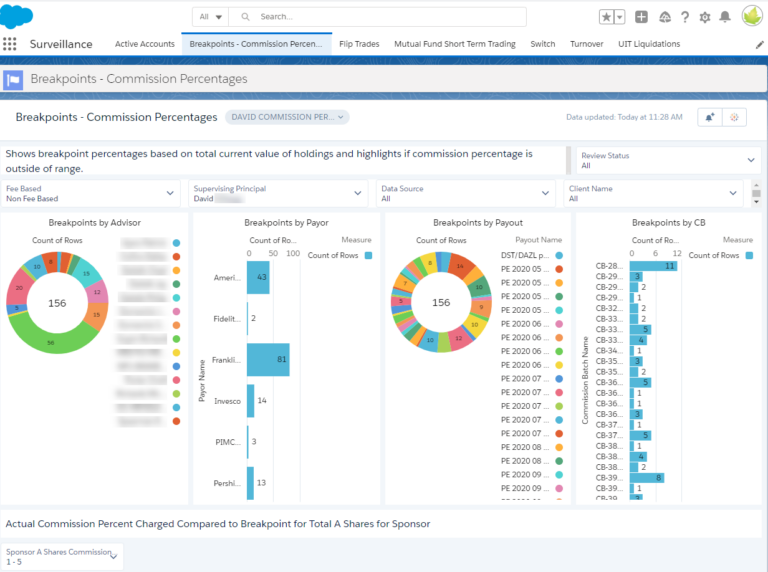

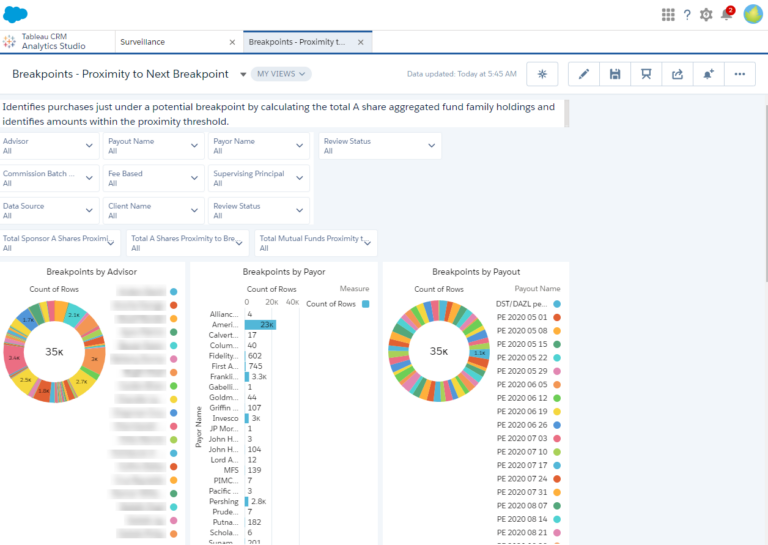

Breakpoints – Commission Percentage

Set filters for any number of days

Choose your payout run

Analyze your most recent payout runs

Drill down on commission transaction, holding and position information

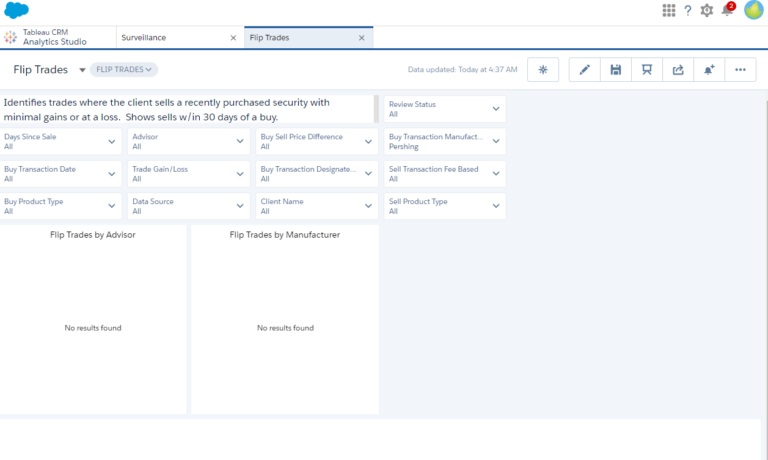

Flip Trades

Flip trades by advisor or by manufacturer

Know when a client sells a recently purchased security for minimal gain or loss, within 30 days of the buy

Pull transaction data from Salesforce for nightly updates via Einstein

Other Alerts

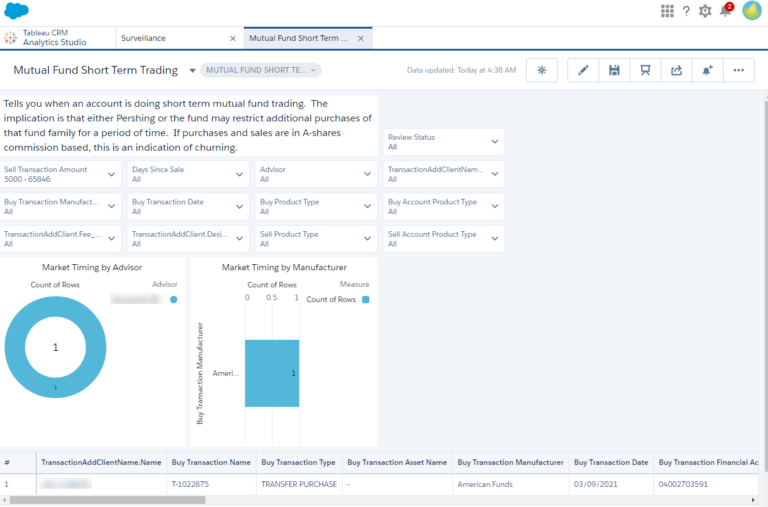

Mutual Fund Short-term Trading

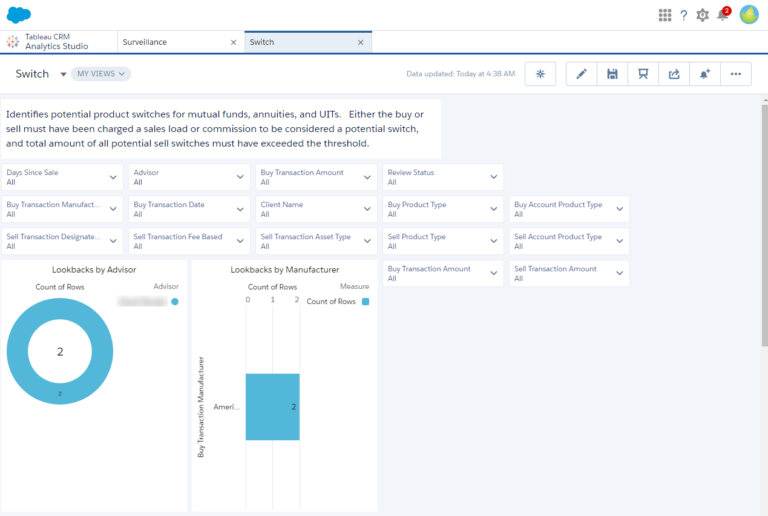

Switch

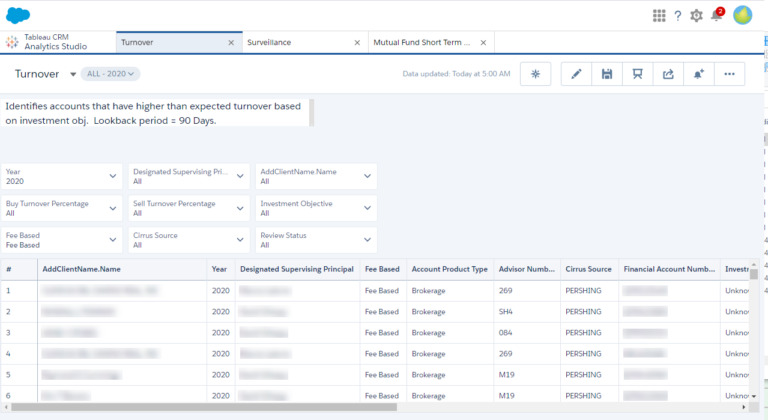

Turnover

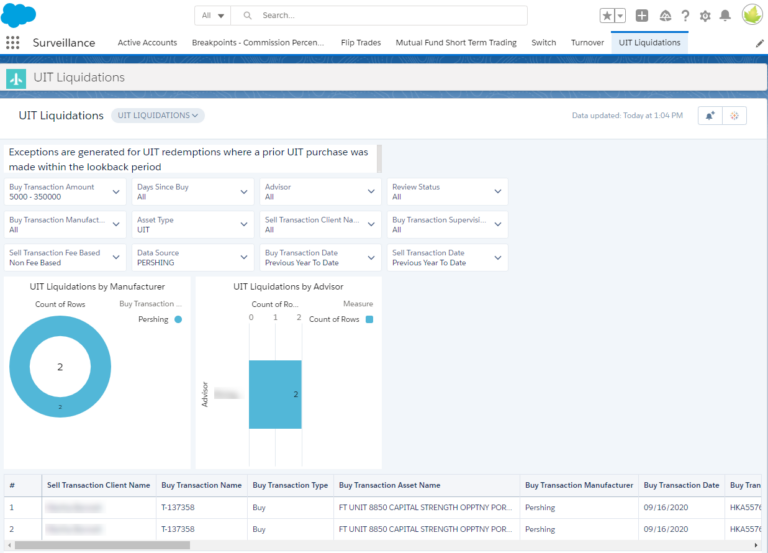

UIT Liquidations

5 Surveillance Technology Capabilities Every Broker-Dealer Should Have

Are your surveillance, supervision and compliance processes manual, fragmented, or constrained by data silos? Discover the five key technology capabilities every broker-dealer must have to effectively mitigate reputational, regulatory and operational risk while increasing efficiencies.

Learn More About Our Compliance Capabilities:

Compliance Management