Connect Your Teams to the Supervision Process

Sycamore gives you the confidence you need to meet regulatory and audit requirements – accurately and on time – while connecting advisors and your teams to the supervision process focused on sales, marketing and trading activities. With Sycamore, you can manage and supervise agents, advisors and their support staff from the prospective advisor stage all the way through to onboarding and beyond. Efficient online interactions and workflows help your teams to access, track and route documents, and manage information between advisors, compliance and registration officers.

Mitigates reputational, internal and regulatory risk from sales practices issues and potential fraud

Ensures compliance with Office of Foreign Assets Control (OFAC), The Financial Crimes Enforcement Network (FinCEN), and other Anti-Money Laundering (AML) requirements

Monitors AML and security trading in accounts, portfolios and funds

Sycamore lets you manage home office requests and compliance approvals, and provides efficient processes to streamline completion of advisors’ compliance requirements. All home office requests and compliance approval workflows are available out of the box and are fully configurable.

Cost-Effective

Eliminates customization costs while simplifying your compliance tech stack

Efficient

Increases efficiencies with data collection and normalization combined with automated workflows

Secure

Supports secure online communication between compliance, supervising principals and advisors

Transparent

Provides management reporting and dashboards to quickly view compliance program effectiveness

Flexible

Provides configurable, out-of-the-box functionality to help your firm shift and scale

Out-of-the-Box Workflows

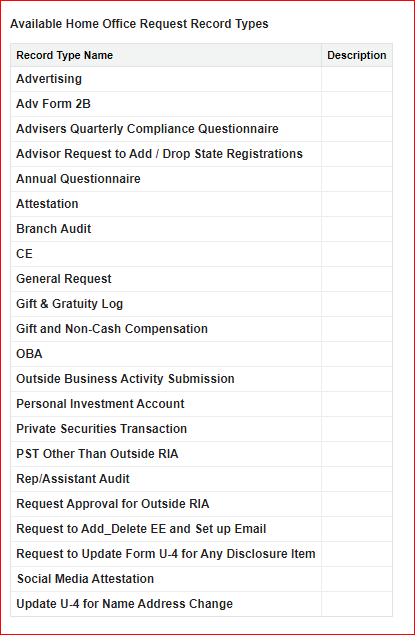

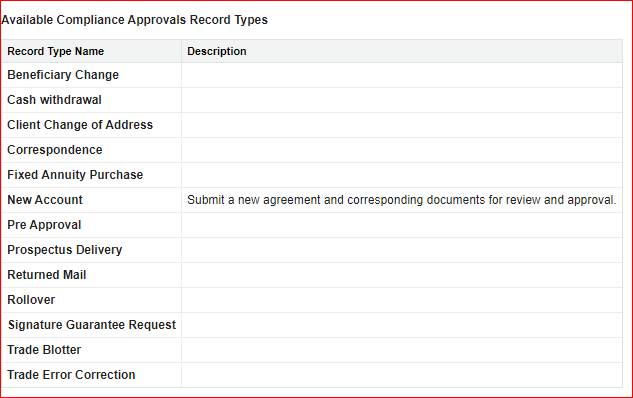

Sycamore provides the following configurable standard workflows to increase efficiencies and accommodate process changes and the need to scale to business growth.

Compliance Approvals

Home Office Requests